Special Report

The Three Most Important Charts for all Investors to Understand

I have been advising clients on wealth creation for nearly forty years and published two best selling books on investing and retirement. If there is one thing I have learnt above all else, then it is “short term returns are impossible and the long term returns are inevitable.

To understand this statement, I want to explain what I mean in three easy charts that I came across the other day.

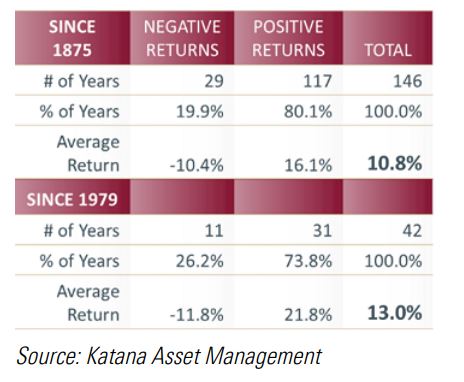

The stock market has “up days” and it has “down days”. The number of “up” days out number the number of “down” days by roughly five to one. In the 146 years that the Australian stock market has existed, the market has risen with growth and dividends on 117 times and declined 29 times. When the market rises, it does so by an average of 16.1% and when it declines, the average is minus 10.4%. When combined, we see that over the past 146 years, the market has averaged a return of 10.8% per annum.

Since Australia has become more sophisticated and introduced the Accumulation Index in 1979, the data points to an even stronger outcome. Over the 42 years since 1979, the market has risen by an average of 13.0% per annum. And this is despite some seriously scary episodes including the 1987 stock market crash, the 1997 Asian financial crisis, the GFC and the fastest crash on record, Covid-19.

Chart Number One – Average Return For The Australian Market Index Of 13.0% Since 1979

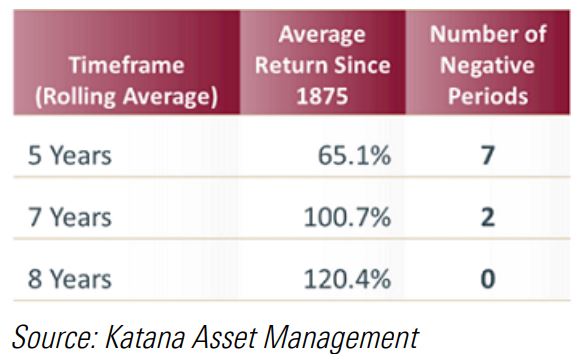

To better understand how the market behaves over different time frames, we can break the data into rolling periods. For example, a rolling five-year period is the average return over every five-year period since 1875.

All you have to do is hold onto your index fund for five years and you can almost eliminate the chance of a negative return.

Chart Number Two – Stay The Distance For 8 Years And Elimate All Negative Returns

Consider these three scenarios to illustrate the point of patient investing:

- If you were to invest your money in the ASX (index), then turned off your computer for five years, when you next logged on, the average return would have been a positive of 65.1%. There would have been only seven occasions out of the 142 rolling five-year periods where you would have a negative return.

- However, had you waited a further two years and logged back on in seven years, on average you would have a 100.7% return and there would have been only two occasions where you would have a negative return.

- Even more remarkably, if you were to invest your money in the ASX (index), and logged back on eight years later, your average return would have been 120.4% and there would have been NO occasions on record where the dividends and capital growth would have been negative.

There is only one long-term trend, and it is UP.

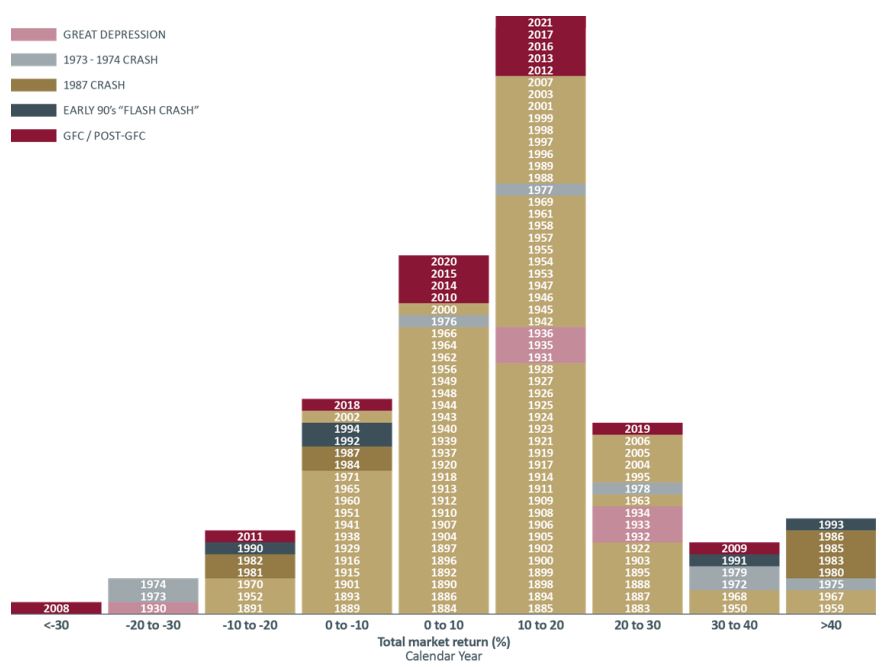

Don’t Miss The Rebound Or You Will Never Recover

Crashes are inevitable; be ready and don’t panic at the bottom. In fact, the best time to panic is at the top. Case in point; there has only been one (calendar) year in the 146-year history of the Australian Stock Market where the market fell by 30% or more, which was in 2008. If you panicked and sold during that crash, you would have missed an extraordinary recovery. In 2009, the market was up by 39.6% and rose in 11 of the 13 years following the crash, as follows –

- 18.8% in 2012

- 19.7% in 2013

- 24% in 2019.

If through age or financial circumstance an investor does not have the luxury of a long-term horizon, then they should understand the extra risk they are taking on with relation to short-term volatility of the market. Remember, in the stock market, volatility really is the price you pay for a seat at the table.

There will be another crash. Guaranteed.

Chart Three-The Proof Of Positve Returns Over Time

There will be a crash. You need to welcome it and not be scared of it. It will provide you with the best buying opportunities.

Let’s Compare The Return Of The U.S. Index Against Aussie Index

The S&P index as illustrated by the price of the IVV ETF that tracks the largest 500 companies in the U.S against the Australian Index XAUS that tracks the largest 200 companies in Australia. A total return of 402.28% versus 60.81%

Finally, nothing in life is guaranteed and investing is no different. What I have tried to illustrate with the three charts above is that patience is the best attribute an investor can have and index investing simplifies the wealth accumulation dilemma.

The investment decision is not whether low cost index investing is the right or wrong way to build wealth over time, but what index is worth investing in.

A professional investment adviser can help you structure a suitable portfolio of indexes including a combination of different countries and industries, as diversifying risk if often the best strategy.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult our office to provide you with personal advice if you would like. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.

Our

7 Step Plan

1. Budgeting

Best Interest Advice will provide you with the essential tools to start giving you a better view of your financial life. By setting up your budgeting and savings goals you are now able to start to work with your financial planning expert to really make sure that you make the changes and improve your saving habits and get you on track.

2. Get ahead of your bills

Get your Bills paid on time. Once you are budgeting better and paying your regular bills in advance rather than when you receive them you feel in control and you know what is coming. No surprises. It sound simple but it is so important. That is why millions of Australians are ditching their credit card and using Debit cards. Don’t spend what you don’t have.

3. Find your Net Worth?

Before you can really start to explore the idea of financial independence you nee to know what you are really worth. Add up all your assets subtract all your debt and that is your net worth. Then you can simply apply the rule of 72. That means assume any interest rate or growth rate and divide it into the number of 72 and that will tell you how many years it takes to double your wealth. For example if your had all your money invested in an index fund returning you 12% every year then it would take you 6 years for your money to double. If you earnt 6% every year it would take you 12 years for your money to double.

4. Protect your future

Insure yourself, against loss of income or total and permanent death and or disability. This goers without saying that you need to measure the risks particularly if you take on debt of you have a family. Others are depending on you and you need to be responsible for the completion of the plan.

5. Taxation planning

Lodge your annual tax return on time and automatically. Australians are no longer leaving it to the last minute to finalise their tax affairs. We integrate taxation planning as a core strategy of your plan. With our Accounting division we are able to recommend the best vehicle for your wealth and make sure that if you are making gains and accruing tax liabilities then how can you develop a strategy to reduce your tax wherever possible.

6. Reduce the fees you pay on all your investment products

By comparing the fees you are paying on your superannuation and mortgage as well as being a bit smarter with your store cards you are able to trim thousands off your expenses every year. Now that you have those items working for you rather than against you it is time to really focus on the thing that makes the biggest difference.

7. Invest like the Pro’s

When you graduate to Step 7 – “Investing like a Pro” – you will follow the same investing principles that the top investors around the world follow. It starts with having a global perspective on asset allocation, taking into account currency fluctuations, relative taxation structures and the best exchange traded funds that are available.

Get started with a free, no obligation strategy session.

Spend two hours with one of Australia’s most experienced and trusted financial planners and walk away with a clear idea of what your ideal life looks like and what we can do to help you achieve it.

Choose a time that suits you.