Global share markets retreat to fair value. Even Bitcoin drops 7%. The importance of dividends needs to be reconsidered.

Income from assets is an important part of overall returns, especially so in a lower interest rate environment and for investors who are partly or wholly dependent on their investments for their living expenses. The Australian share market is known globally for its higher dividend yield and many local investors take advantage of this.

There are structural reasons for the higher dividends payed by Australian listed companies. A key driver is the beneficial tax treatment known as dividend imputation. This is a recognition that companies pay dividends from after-tax profits. The imputation of these tax credits avoids taxing the same profits twice – once at the company level and again in the hands of shareholders. It should come as no surprise that 11 of the top 30 dividend yields are financial stocks, including all the big four banks.

The direct relationship between risk and reward also applies to dividends. A lower share price results in a higher dividend yield. Higher returns from a company can be an indication of higher risk. That is, investors overall require higher income returns to compensate for a higher level of risk in holding that share. Income considerations play a role in investment decisions at any time of the market cycle. However, they receive much more weight in time of lower interest rates.

The answer for many investors is to employ one of the most powerful risk management tools available: diversification. Diversifying within income-generating investments of a portfolio, as well as into assets with other dominant characteristics, can allow investors to create a portfolio that generates reasonable income and is potentially more capital stable.

Can you invest in a share that has great growth prospects and a high dividend.

When we investing for both we find that it is generally one or the other.

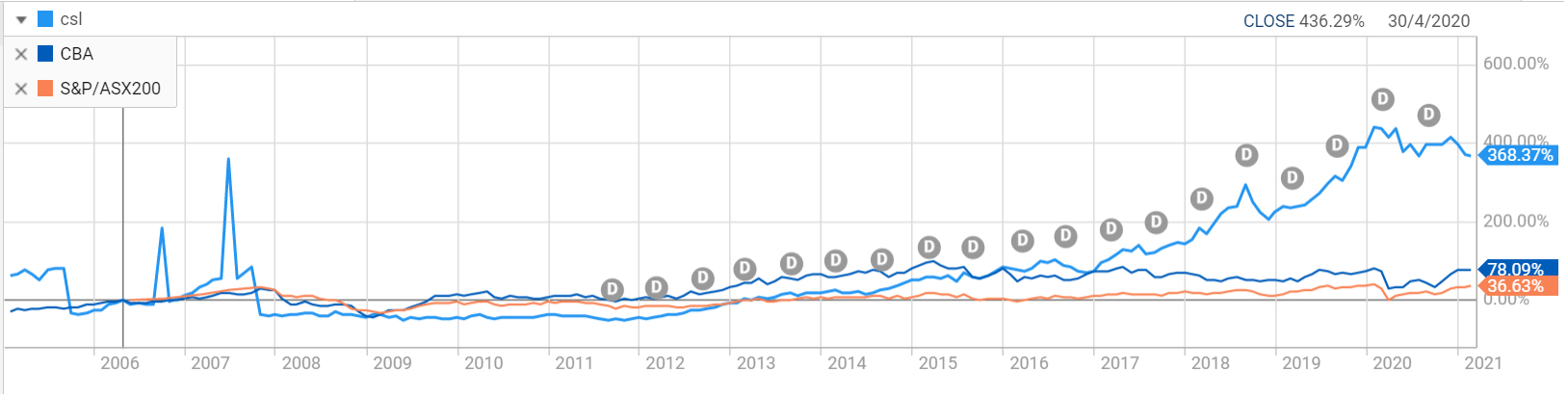

Let’s look at two of the darlings of the share market in Australia being CSL and Commonwealth Bank. CSL share price has increased by 368% since 2006. However it pays a small dividend historically of 1.16% Compare that to Commonwealth Bank.

Comm Bank share price has increased by 78% over the last 14 years and paid a dividend yield of 3.03% that was fully franked and has been since 1991. To boost dividends many client choose to reinvest their dividends. This creates a compounding affect on their wealth.

Let’s compare CSL and CommBank over the last 14 years.

Amazon and Microsoft – Two growth stocks that are measured not by their dividends but their growth.

Way back in 1986 Microsoft listed on the stock exchange it took until 2003 before it paid it’s first ever dividend. Although it has paid a dividend since 2004 it has been less than 1%. It’s forward dividend payment is 0.96%.

One lingering holdout to paying dividends to shareholders is e-commerce giant Amazon.com Inc. (AMZN). Rather than return cash to shareholders, Amazon continues to plow its cash flow back into the business. Amazon could pay a dividend if it chose to. Amazon is free cash flow-positive, meaning it generates free cash flow that could be used to pay dividends. Amazon’s lack of a dividend certainly has not hurt investors to this point, as Amazon has been a premier growth stock. Over the past 10 years, Amazon stock generated returns of approximately 34% per year. Amazon had razor-thin profit margins for many years of its growth phase. That said, the company was profitable in every year over the past decade except 2014. Amazon has continued to post impressive growth, even in 2020 when the coronavirus sent the U.S. economy into a recession. On October 29th, 2020 Amazon released third-quarter results. For the quarter, Amazon generated net sales of $96.1 billion in revenue, up 37% compared to the same quarter a year ago.

Can you look at investing for Dividends globally and is it the way to smooth out returns.

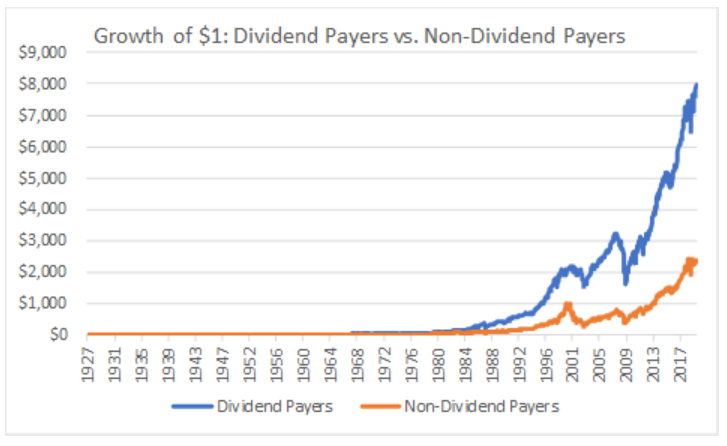

Data going back to 1927 show that the performance of companies that pay a dividend deliver a better return.

An excellent presentation was given by Alan McFarlane Senior Partner from Dundas Global investors from Scotland why dividend investing globally is a strategy for more conservative investors and retirees.

Some reasons why companies that pay a dividend are better prospects for investors can be summarised by the following points:–

- Dividend growth + dividend yield > 80% of long run equity return.

- Sustainable dividend growth companies provide strong ESG results

- Good capital allocation decisions require robust corporate governance.

- Dividend growth comes from high quality companies with good capital allocation

“As the investment horizon increases, the fundamentals (namely, dividend yield and dividend growth) become the dominant sources of performance, explaining more than 90% of total equity returns over 20 years*”

We are about to modify our model portfolio’s and add an allocation to specific funds that look for high dividend companies that have stable dividend history. This will become more popular as the share market start to revert to fair value.

Source: MSCI 2016 study of long-term return on behalf of the Norwegian Ministry of Finance. *Returns are averages over rolling periods.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.