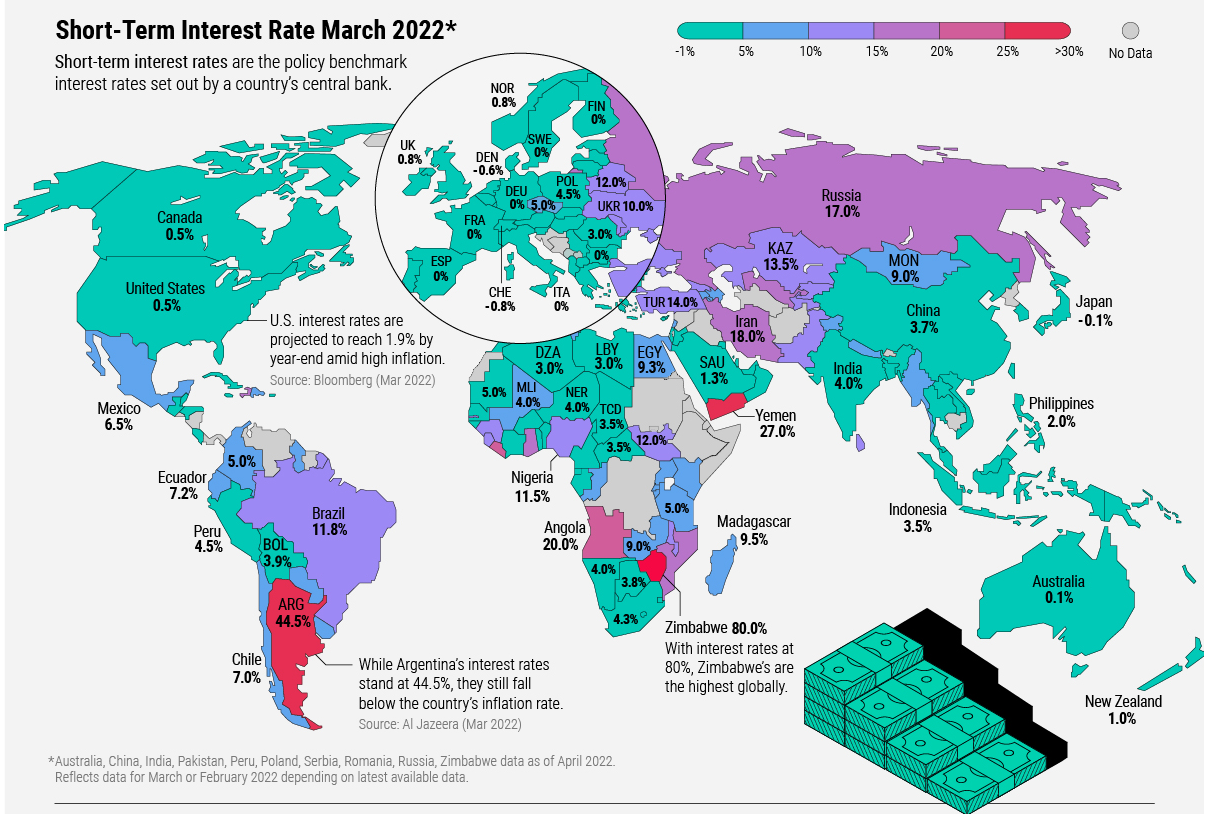

When the Federal Reserve moved Wednesday to raise interest rates by the most in 22 years, the primary goal was to tame record inflation. But also in its sights was a cooling off of a scorching-hot housing market.

Anyone who’s strolled around an American city lately will know that the market is turbo charged. In California, homes are fetching bids millions of dollars over their asking prices. Over 50% of people surveyed from a bank in America said that they would even get a second job to get a deposit for a home; such is the demand and the enormous wealth affect of owning your own home.

In February, one measure of house prices in 20 U.S. cities rose 20.2% from the year prior. In Australia, the market has already started to cool considerably.

Do Mums and Dads think they can withstand another two interest rate increases this year?

Whenever the RBA does decide to raise the cash rate, banks and other lenders will most likely follow and lift their rates too. And that means repayments will also go up. The advice from a senior bank official outlined the following – “for borrowers, the strongest advice is to understand what that means for their finances”.

“Are you able to meet your repayments under that scenario? What options [are there] to fix a portion of your loan?

“It’s better to get set now, while you still have this window of opportunity to get set before rates do rise.”

So for example, if the RBA raises the cash rate to 1% and banks pass that on in full, then the average home loan interest rate would be 3.88%. If you had a $500,000 home loan, you would expect to pay an extra 5 x $50 = $500 a month on your repayments.

If the cash rate rises to 2%, and that’s passed on in full, the monthly repayment on that $500,000 home loan would go up by 5 x $108.99 = $544.95. That’s an increase of 25.9% on the $2,102.63 monthly repayment at the current average rate.

A look at the current state of the markets from our Economist, Chris Watling

Dinner in New York

Conferences and round table diners are, of course, a good way to judge the mood of markets. This week, we attended a large 30 person round table dinner in New York. The mood was markedly bearish, almost without exception. Speaker after speaker expounded the short equities, short bonds thesis. War in Europe, oil to $200, gas shortages, real income squeezes, recession risk and ongoing inflation (a new structural macro regime, the return of the 1970s). Indeed, many of the FX/bond/macro folks suggested that the equity folks don’t get it. “Financial conditions have to tighten”. Investing’s unholy trinity means that either equities, bonds or the dollar will have to be sacrificed by the Fed. That is, either the Fed supports the bond and FX market by raising interest rates (squeezing loose money); or money remains loose and equities buoyant? Around the room, it was equities that were expected to be on the altar. No-one (present company excepted) took a bullish tilt. The most bullish statement that a few of the bears could muster was that equities might rally in Q4.

Naturally they may, of course, all be right. Equally, though, markets are forward looking and as Buffett’s mentor famously stated:

“In the short run markets are a voting machine, in the long run a weighing machine”

Source: Benjamin Graham

What about the “R” word?

Do you have to have a recession to curb inflation?

The definition of a recession is two negative quarters of growth so the consensus is that it won’t be this year but the money is on things slowing down during 2023 and then we may be closer to a recession if we don’t get inflation under control. In conclusion, do you have to have a recession to cool the economy and beat inflation? We will wait and see.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement.

Target Market Determination. We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives.” or terms and conditions, You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.