28 August 2020

This economy can’t run hot enough to generate inflation of more than 2%.

Last week our global economist Chris Watling spoke to us about inflation or deflation. This will be a large issue later this year when all the quantitative easing (QE) from governments starts to ease and and all the stimulus starts to dry up.

Global stocks are heading for a fifth week of gains as technology shares continue to push higher and investors monitor progress on vaccine developments for the pandemic. Reports showed that U.S. weekly jobless claims remained above 1 million and the economy contracted slightly less than forecast in the second quarter.

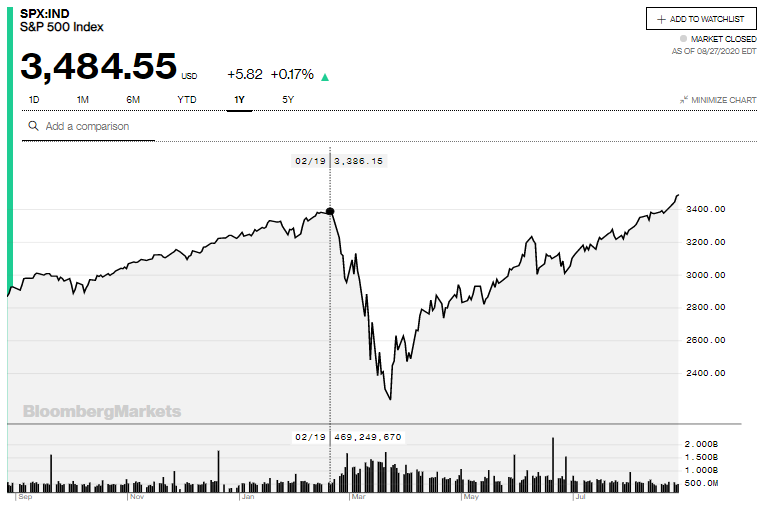

This equity market continues to confound the sceptics. Since its pandemic lows, there’s been no retest of its initial lows, the S&P500 has barely experienced any serious drawbacks, while it’s now back at its all-time highs (with tech notably above its prior highs). Equally on the economic front, the strength of the bounce in much of the data has surprised many observers, and likely speaks to the size of the stimulus response by policy makers across the globe.

With that, the S&P500’s rolling 12 month forward PE ratio has gone from a low of 13.6x in the depths of the SELL-OFF, reaching over 22x forward earnings in recent weeks. It has now beaten its previous high of 3,386 on February 19 2020. Most of our clients have both the following indexes in their portfolios via the IVV ETF and the NDQ ETF.

The Nasdaq Index is even more impressive. It has gone from 9,732 points on February 19 to 11,625 as at 27 August 2020.

There’s a clear correlation between the S&P 500’s forward PE ratio and the amount of QE that the Fed is undertaking. In the past 5 months the Fed has carried out close to 2/3rds of the amount of QE it executed over 5 years from 2009 through to 2014, hence the dramatic re-rating of equity markets. This has flooded the markets with liquidity that has to be invested and utilized. This is in the face of increased bankruptcy notices and small business pressures.

Ray Dalio investment specialist in the U.S says that the world that we live in today and the monetary system is dramatically different to any other time in history.

In 2008 the governments and Central Banks had to protect the financial institutions and Banks because they were so important to the monetary system. We could not afford to have them fail and default. Today the central banks are protecting the whole economy. We cannot afford to have businesses and the financial system fail. That is why the markets are still confident buying equities and flooding the market with liquidity because they know that if there is a contraction then governments would fail not banks. This would lead to global conflicts and a new world order. This is also a reason why the price of gold just keeps going up. It is seen as a safe haven in potential conflicts.

When the stimulus stops so will the markets. Businesses have retooled their strategies to accommodate the online revolution and distribution. Credit is available and banks are encourage to keep lending. We are all in this together.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.