Will 2021 be the worst year for bonds?

Investors have learnt more in the last 12 months on how bonds work than at any time in history. Who would have thought that the best you would earn in the bank would be less than 1%. Who would have ever considered a negative return on Government Bonds?

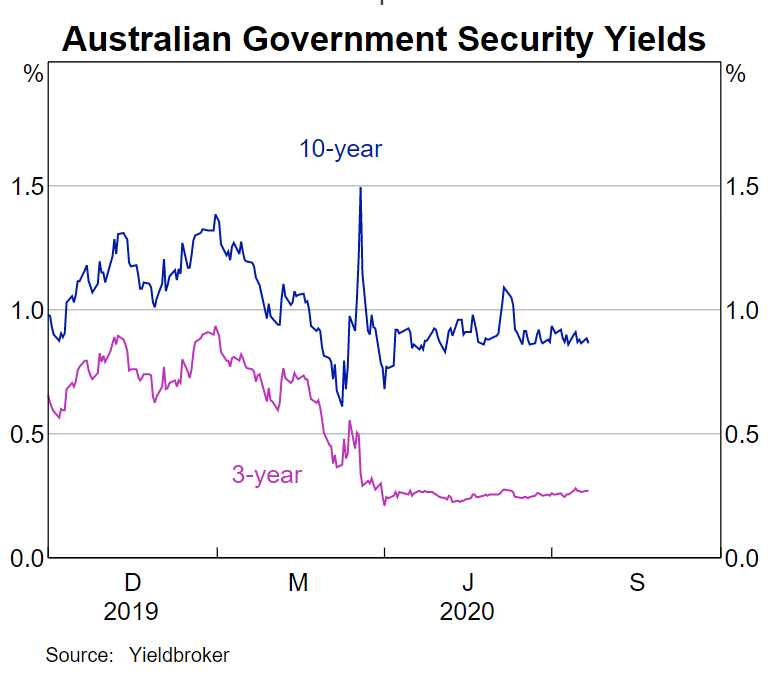

Australian Government bond yields have increased like the U.S and that means that if you are holding long dated bonds, then you would have seen a negative return in the last couple of months. Many investment professionals feel as though this market has over reacted and we will see smoother returns in the short term.

Last August, yields on the U.S. 10-year Treasury bottomed out around 0.5%. Last month, they hit triple that at 1.5%. When bond yields rise, bond prices fall, so 2021 has not started well for fixed income investors.

This recent upside in bond yields has been the reason why the capital value of long term bonds has gone negative. Once they stabilize, investors should reassess their asset allocation.

How do Bonds work?

First, let’s review the basics of bonds…

A bond’s yield is the annual return you get from holding it to maturity i.e. when the loan is paid back. Future cash flow returns of a bond are fixed, so when the price goes down, the yield goes up.

That shouldn’t be as confusing as it sounds! It’s the same for a dividend stock. The cheaper the share price, the higher the dividend yield, if nothing else changes.

What makes bonds interesting isn’t so much their yields though. The yield alone doesn’t tell you what you need to know. Its all relative to other investments like equities. Currently, the 10-year Treasury bond is down over 4% for 2021. “Safe haven” assets like long-dated Treasury bonds are not supposed to lose such a large chunk of the principal so quickly.

It is notable that one of the all-time worst years for bonds was 2009. Right as the global economy was emerging from the financial crisis, so investors moved from the safe haven of bonds to riskier assets. We may be seeing a similar dynamic in 2021, though of course, much depends on how reopening progresses and the policy responds to it. To the extent investors remain comfortable taking risk, bonds – especially government bonds – will likely suffer.

Does the outlook for Inflation affect bonds?

The other question on the minds of investors is inflation. Even the Fed has stated that getting growth back is the priority over inflation, for now. However, the massive stimulus used to fight some of the worst effects of the pandemic has not been cheap. The efforts to fight the pandemic with stimulus checks, enhanced unemployment payments, PPP loans and other government spending has led to a spike in M2 by over 20%. That sort of spike over a short period is unprecedented. Some economists worry inflation will result. If it does, it’s seldom a good outcome for bonds.

It is possible that a massive bull run in bonds may be over. Since the early 1980s, yields on 10-year bonds have tumbled from 15% all the way down to around 1%. There have been bumps along the way such as 1999, 2009 and 2013 but generally, the 10-year has put in a great long-term performance.

Even a bad year for bonds is likely to be pretty tame compared to what we could see in a bad year for stocks. If the bond market is stuttering because of investors shifting to riskier positions, that’s less worrying for stocks, but if an inflation spike is coming, stock investors may have cause to worry.

So wait and hold for the short term to pick up any income distributions then plan to invest in alternative cash and fixed interest securities that are shorter duration so you can ride the rise of interest rate in 24 to 36 months.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.