“Australia is a global leader in everything the green future needs – all the sun, wind and elements of renewable electricity,” Forrest said.

“Nearly 100% of the manufactured items that go into the solar industry come from overseas; it’s time to stop that. We’re going to be such a massive consumer of PV cells, of wind turbines, everything to build out that green future. Let’s build it right here in Australia.”

“Hydrogen” is the word on everyone’s lips, as the most abundant of all the elements is tapped as the clean energy source of the future.

To produce hydrogen, water is put through electrolysis – that is, using an electric current to break water, H2O, into its component elements of hydrogen and oxygen, both in gas form. If this electric current is produced by a renewable source (for example, solar PV or a wind turbine), the clean hydrogen produced is known as “green” hydrogen. The oxygen is benign waste.

It is certainly possible, relatively quickly, to produce green hydrogen in this way. If you use a dedicated renewable power system and don’t use any additional power from the grid, you’re producing hydrogen with nearly zero emissions (apart from that which resulted from smelting, building, transporting and installing all of the required equipment).

What is Fortescue up to?

Fortescue Metals Group has told its shareholders that the company will also become a hydrogen and steel superpower, unveiling plans to build a steel-making industry in Australia, making “green” steel – zero-carbon steel, using zero carbon-dioxide-emissions energy – as well as becoming one of the world’s largest clean-energy companies. Fortescue has formed a new arm, Fortescue Future Industries (FFI), which will take oversight of these plans.

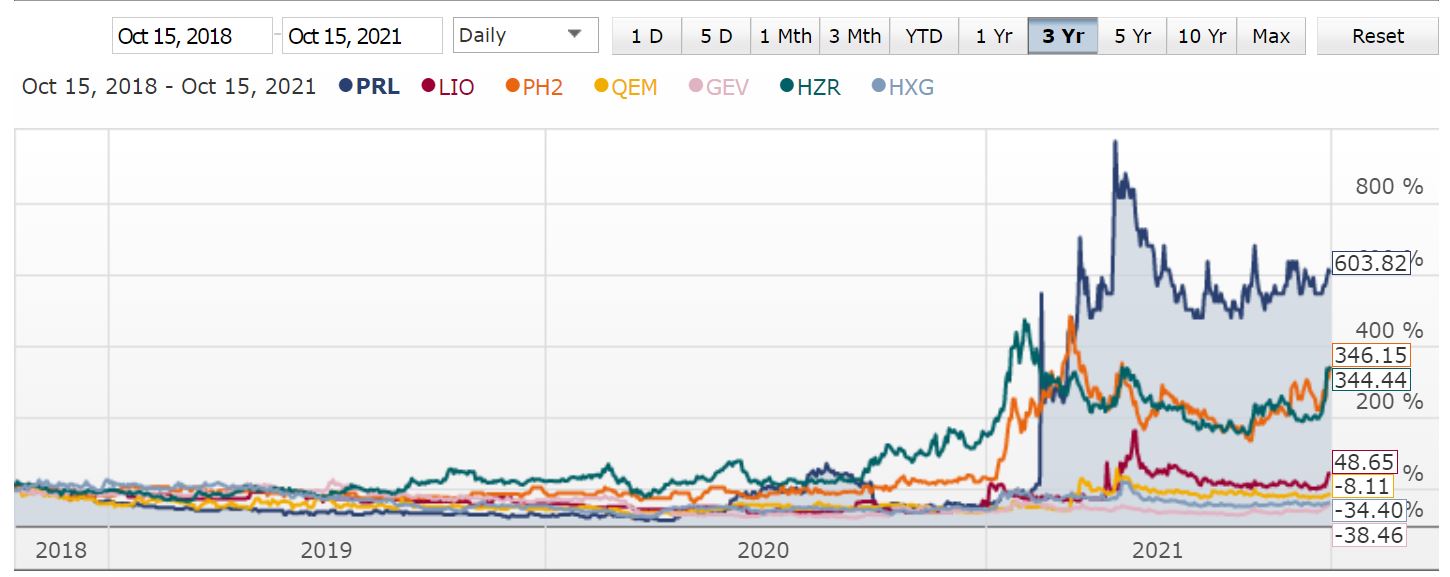

Take a look at the returns of Hydrogen companies over the last THREE YEARS.

- ASX: PH2 PURE HYDROGEN CORP +346%

- ASX:PRL PROVINCE RESOURCES +603%

- ASX:LIO LION ENERGY +48%

- ASX:QEM QEM -8%

- ASX:GEV GLOBAL ENERGY VENTURES -34%

- ASX:HZR HAZER GROUP +344%

- ASX:HXG HEXAGON ENERGY MINERALS -34%

What if you could have all the best companies together in one ETF?

The VanEck Global Clean Energy ETF (ASX code: CLNE) is designed to meet the growing demand for renewable energy.

“Our ETFs include only the ESG leaders in their sector relative to peers. Going beyond just exclusion is something investors should consider, otherwise we would argue it is just ‘greenwashing’.” says Arian Neiron of VanEck.

Compare Fortescue share price over the same period. That’s why he is moving.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.